SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

Preliminary Proxy Statement | ||

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

Definitive Proxy Statement |

Definitive Additional Materials |

Soliciting Material Pursuant to § 240.14a-12 |

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| x | ||||

No fee required. | ||||

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

Fee paid previously with preliminary materials. | ||||

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

6. | Amount Previously Paid: |

| 7. | Form, Schedule or Registration Statement No.: |

| 8. | Filing Party: |

| 9. | Date Filed: | |||

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION

10260 Campus Point Drive

San Diego, California 92121

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held July 16, 2004June 10, 2005

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Science Applications International Corporation, a Delaware corporation (the "Company"“Company”), will be held in the Grand Ballroom of the Hilton La Jolla Torrey PinesMarriott Hotel, 10950 North Torrey Pines Road,4240 La Jolla Village Drive, San Diego, California, on Friday, July 16, 2004,June 10, 2005, at 10:00 A.M. (local time), for the following purposes:

1. To elect sixfour Class IIIII Directors, each for a term of three years;

2. To approve the 2004 Employee Stock Purchase Plan;

3.2. To vote on a stockholder proposal regarding the Company'sCompany’s classified Board; and

4.

3. To transact such other business as may properly come before the meeting or any adjournments, postponements or continuations thereof.

Only stockholders of record at the close of business on May 19, 2004,April 26, 2005, are entitled to notice of and to vote at the Annual Meeting and at any and all adjournments, postponements or continuations thereof. A list of stockholders entitled to vote at the meeting will be available for inspection at the office of the Secretary of the Company at 10010 Campus Point Drive, San Diego, California for at least 10 days prior to the meeting and will also be available for inspection at the meeting.

By Order of the Board of Directors

D.E. SCOTT

Senior Vice President,

General Counsel and Secretary

San Diego, CaliforniaJune 4, 2004

May 12, 2005

YOUR VOTE IS IMPORTANT

You are cordially invited to attend the Annual Meeting. However, to ensure that your shares are represented at the meeting, please submit your proxy (1) over the Internet, (2) by telephone or (3) by mail. For specific instructions, please refer to the questions and answers beginning on the first page of this proxy statement and the instructions on the enclosed proxy card. Submitting a proxy will not prevent you from attending the Annual Meeting and voting in person, if you so desire, but will help the Company secure a quorum and reduce the expense of additional proxy solicitation.

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION

10260 Campus Point Drive

San Diego, California 92121

ANNUAL MEETING OF STOCKHOLDERS

To Be Held July 16, 2004June 10, 2005

PROXY STATEMENT

This Proxy Statement is being furnished to the stockholders of Science Applications International Corporation, a Delaware corporation (the "Company"“Company”), in connection with the solicitation of proxies by its Board of Directors for use at the Annual Meeting of Stockholders of the Company (the "Annual Meeting"“Annual Meeting”) to be held in the Grand Ballroom of the Hilton La Jolla Torrey PinesMarriott Hotel, 10950 North Torrey Pines Road,4240 La Jolla Village Drive, San Diego, California, on Friday, July 16, 2004,June 10, 2005, at 10:00 A.M. (local time), and at any and all adjournments, postponements or continuations thereof. This Proxy Statement and the enclosed form of proxy are first being mailed to the stockholders of the Company on or about June 4, 2004.May 12, 2005.

INFORMATION ABOUT THE ANNUAL MEETING

What is the purpose of the Annual Meeting?

At the Annual Meeting, the stockholders of the Company are being asked to consider and vote upon:

| 1. | the election of four Class III Directors, each for a term of three years; |

| 2. | a stockholder proposal regarding the Company’s classified Board; and |

| 3. | such other business as may properly come before the meeting or any adjournments, postponements or continuations thereof. |

When and where will the Annual Meeting be held?

The Annual Meeting will be held in the Grand Ballroom of the Hilton La Jolla Torrey PinesMarriott Hotel, 10950 North Torrey Pines Road,4240 La Jolla Village Drive, San Diego, California, on Friday, July 16, 2004,June 10, 2005, at 10:00 A.M. (local time).

Who can attend the Annual Meeting?

All stockholders or their duly appointed proxies may attend the meeting.

INFORMATION ABOUT VOTING RIGHTS AND SOLICITATION OF PROXIES

Who is entitled to vote at the Annual Meeting?

Only stockholders of record of the Company'sCompany’s Class A common stock, par value $.01 per share (the "Class“Class A common stock"stock”), and/or Class B common stock, par value $.05 per share (the "Class“Class B common stock"stock”), as of the close of business on May 19, 2004April 26, 2005 (the "Record Date"“Record Date”), are entitled to notice of and to vote at

1

the Annual Meeting. As of the Record Date, the Company had 182,909,109174,753,404 shares of Class A common stock and 222,451216,593 shares of Class B common stock outstanding. The Company has no other class of capital stock outstanding. The Class A common stock and the Class B common stock are collectively referred to herein as the "Common Stock"“Common Stock” and vote together as a single class on all matters.

What constitutes a quorum?

The presence at the meeting, either in person or by proxy, of the holders of a majority of the total voting power of the shares of Common Stock outstanding on the Record Date is necessary to constitute a quorum and to conduct business at the Annual Meeting. Although abstentions may be specified on all proposals (other than the election of Directors), abstentions will only be counted as present for purposes of determining the presence of a quorum.

How many votes am I entitled to?

Each holder of Class A common stock will be entitled to one vote per share and each holder of Class B common stock will be entitled to 20 votes per share, in person or by proxy, for each share of Common Stock held in such stockholder'sstockholder’s name as of the Record Date on any matter submitted to a vote of stockholders at the Annual Meeting. However, in the election of Directors, all shares are entitled to be voted cumulatively. Accordingly, in voting for Directors: (i) each share of Class A common stock is entitled to as many votes as there are Directors to be elected, (ii) each share of Class B common stock is entitled to 20 times as many votes as there are Directors to be elected and (iii) each stockholder may cast all of such votes for a single nominee or distribute them among any two or more nominees as such stockholder chooses. To apportion your votes among two or more nominees other than on a pro rata basis, you must submit your proxy using a proxy card or by voting in person at the Annual Meeting. You may not submit your proxy over the Internet or by telephone if you wish to distribute your votes unevenly among two or more nominees. Unless otherwise directed, shares represented by properly executed proxies will be voted at the discretion of the proxy holders so as to elect the maximum number of the Board of Directors'Directors’ nominees that may be elected by cumulative voting.

How do I vote my shares?

Shares of Common Stock represented by properly executed proxies received in time for voting at the Annual Meeting will, unless such proxies have previously been revoked, be voted in accordance with the instructions indicated thereon. In the absence of specific instructions, the shares represented by properly executed proxies will be voted FOR the election of Directors so as to elect the maximum number of the Board of Directors'Directors’ nominees that may be elected by cumulative voting FOR the approval of the 2004 Employee Stock Purchase Plan and AGAINST the stockholder proposal regarding the Company'sCompany’s classified Board. No business other than that set forth in the accompanying Notice of Annual Meeting is expected to come before the Annual Meeting; however, should any other matter requiring a vote of stockholders properly come before the Annual Meeting, it is the intention of the proxy holders to vote such shares in accordance with their best judgment on such matter.

There are four different ways to vote your shares:

Vote by Internet: You may submit a proxy or voting instructions by the Internet by following the instructions at www.proxyvote.com.

Vote by Telephone: You may submit a proxy or voting instructions by calling 1-800-690-6903 and following the instructions.

Vote by Mail: If you received your proxy materials via the U.S. mail, you may complete, sign and return the accompanying proxy and voting instruction card.card in the postage-paid envelope provided.

Vote in Person: If you are a stockholder as of the record dateRecord Date and attend the meeting, you may vote in person at the meeting.

2

Submitting a proxy will not prevent a stockholder from attending the Annual Meeting and voting in person. Any proxy may be revoked at any time prior to the exercise thereof by delivering in a timely manner a written revocation or a new proxy bearing a later date to the Secretary of the Company as described below, or by attending the Annual Meeting and voting in person. The mailing address of the Corporate Secretary is 10260 Campus Point Drive, San Diego, California 92121. Attendance at the Annual Meeting will not, however, in and of itself constitute a revocation of a proxy.

How are the shares held by the Retirement Plans voted?

Each participant in the Employee Stock Retirement Plan ("ESRP"(“ESRP”), and the 401(k) Profit Sharing Plan ("(“401(k) Profit Sharing Plan"Plan”) of the Company, the Telcordia Technologies 401(k) Savings Plan of Telcordia Technologies, Inc., a wholly-owned subsidiary of the Company until its sale on March 15, 2005 (the "Telcordia Plan"“Telcordia Plan”), and the AMSEC Employees 401(k) Profit Sharing Plan of AMSEC LLC, a joint venture in which the Company owns 55% (the "AMSEC Plan"“AMSEC Plan”) (collectively, the "Retirement Plans"“Retirement Plans”) has the right to instruct Vanguard Fiduciary Trust Company (the "Trustee"“Trustee”), as trustee of the Retirement Plans, on a confidential basis how to vote his or her proportionate interests in all allocated shares of Common Stock held in the Retirement Plans. The Trustee will vote all allocated shares held in the Retirement Plans as to which no voting instructions are received, together with all unallocated shares held in the Retirement Plans, in the same proportion, on a plan-by-plan basis, as the allocated shares for which voting instructions have been received. The Trustee'sTrustee’s duties with respect to voting the Common Stock in the Retirement Plans are governed by the fiduciary provisions of the Employee Retirement Income Security Act of 1974, as amended ("ERISA"(“ERISA”). The fiduciary provisions of ERISA may require, in certain limited circumstances, that the Trustee override the votes of participants with respect to the Common Stock held by the Trustee and to determine, in the Trustee'sTrustee’s best judgment, how to vote the shares.

How are the shares held by the Stock Plans voted?

Under the terms of the Company'sCompany’s Stock Compensation Plan, Management Stock Compensation Plan and Key Executive Stock Deferral Plan (collectively, the "Stock Plans"“Stock Plans”), Wachovia Bank, N.A. ("Wachovia"(“Wachovia”), as trustee of the Stock Plans, has the power to vote the shares of Class A common stock held by Wachovia in the Stock Plans. Wachovia will vote all such shares of Class A common stock in the same proportion that the other stockholders of the Company vote their shares of Common Stock.

Who is soliciting these proxies?

The Company is soliciting these proxies and the cost of the solicitation will be borne by the Company, including the charges and expenses of persons holding shares in their name as nominee for forwarding proxy materials to the beneficial owners of such shares. In addition to the use of the mails, proxies may be solicited by officers, Directors and regular employees of the Company in person, by telephone

or by email. Such individuals will not be additionally compensated for such solicitation but may be reimbursed for reasonable out-of-pocket expenses incurred in connection with such solicitation.

PROPOSAL I—ELECTION OF DIRECTORS

The Company'sCompany’s Certificate of Incorporation provides for a "classified"“classified” Board of Directors consisting of three classes which shall be as equal in number as possible. The number of authorized Directors is currently fixed at 2015 Directors, with sixfour Directors in Class I and Class III, and eight Directors in Class II. D.P. Andrews and J.P. Walkush were reclassified as Class II Directors to cause thefive Directors in each classof Class I and II and one vacancy. The Board of Directors will review the authorized number of Directors at its next meeting to be as equal indetermine whether to fix the authorized number as possible after the annual election of Directors.Directors at a lower number or appoint individuals to fill any vacancies.

At the Annual Meeting, sixfour Class IIIII Directors are to be elected to serve three-year terms ending in 20072008 or until their successors are elected and qualified or their earlier retirement, death, resignation or removal or disqualification from service as a Director pursuant to any current or future provision of the Bylaws. Currently, D.P. Andrews, J.R. Beyster, K.C. Dahlberg, M.J. Desch, M.E. Trout, J.P. Walkush, J.H. Warner,

3

W.A. Downing, D.H. Foley, A.K. Jones and E.J. Sanderson, Jr. and A.T. Young serve as Class IIIII Directors. All such Class IIIII Directors will be standing for reelection other than J.R. Beyster and M.E. Trout who are retiring fromwith the Board at the endexception of their terms after 35 and 9 years of service, respectively. AsW.A. Downing. In addition, J.J. Hamre has been nominated to stand for election as a result, effective as of July 16, 2004,Class III Director. All nominees have been nominated by the Board of Directors reducedbased on the numberrecommendation of authorized directors to 18.the Nominating and Corporate Governance Committee. The sixfour nominees who receive the most votes will be elected as Class IIIII Directors. It is intended that, unless otherwise indicated, the persons named in the enclosed form of proxy holders will vote FOR the election of Directors so as to elect the maximum number of the Board of Directors'Directors’ nominees that may be elected by cumulative voting. Abstentions and withheld votes will have no effect on the outcome of this vote. Each nominee has consented to be named in this proxy statement and to serve if elected. To the best knowledge of the Board of Directors, all of the nominees are, and will be, able and willing to serve. In the event that any of the sixfour nominees listed below should become unable to stand for election at the Annual Meeting, the proxy holders intend to vote for such other person, if any, as may be designated by the Board of Directors, in the place and stead of any nominee unable to serve. Alternatively, the Board of Directors may elect, pursuant to Section 3.02 of the Company'sCompany’s Bylaws, to fix the authorized number of Directors at a lower number so as to give the Nominating Committee of the Board of Directors additional time to evaluate candidates.

The Board of Directors unanimously recommends a vote FOR each nominee. Set forth below is a brief biography of each nominee for election as a Class IIIII Director and of all other members of the Board of Directors who will continue in office:

NOMINEES FOR ELECTION AS CLASS III DIRECTORS—TERM ENDING 2008

D.H. Foley, age 60 Executive Vice President and Director | Director since 2002 | |

Dr. Foley joined the Company in 1992 and has served as an Executive Vice President since 2000, Group President since February 2004, and a Director since July 2002. In January 2005 he was appointed as Chief Engineering and Technology Officer. Dr. Foley served as a Sector Vice President from 1992 to 2000. | ||

| J.J. Hamre, age 54 | Nominee for Director | |

Dr. Hamre has served as the President and Chief Executive Officer of the Center for Strategic & International Studies, a public policy research institution, since 2000. Prior thereto, Dr. Hamre served as U.S. Deputy Secretary of Defense from 1997 to 2000 and Under Secretary of Defense (Comptroller) from 1993 to 1997. Dr. Hamre is also a member of the Board of Directors of ChoicePoint, Inc., ITT Industries, Inc., Integrated Nano-Technologies and MITRE Corporation. | ||

A.K. Jones, age 63 Director | Director since 1998 | |

Dr. Jones is the Quarles Professor of Engineering at the University of Virginia where she has taught since 1989. From 1993 to 1997, Dr. Jones was on leave of absence from the University to serve as Director of Defense Research and Engineering in the U.S. Department of Defense. Dr. Jones also served as a Director of the Company from 1987 to 1993. | ||

E.J. Sanderson, Jr., age 56 Director | Director since 2002 | |

Mr. Sanderson retired from Oracle Corporation in 2001 after having served as an Executive Vice President since 1995. At Oracle, Mr. Sanderson was responsible for Oracle Product Industries, Oracle Consulting, and the Latin American Division. Prior to that he was President of Unisys World-wide Services and partner at both McKinsey & Company and Accenture (formerly Andersen Consulting). Mr. Sanderson is also a member of the Board of Directors of Quantum Corporation and serves on several non-profit boards. | ||

4

CLASS I DIRECTORS—TERM ENDING 2006

W.H. Demisch, age 60 Director | Director since 1990 | |

Mr. Demisch has been a principal of Demisch Associates LLC, a consulting firm, since 2003. He was a Managing Director of Dresdner Kleinwort Wasserstein, formerly Wasserstein Perella Securities, Inc., from 1998 to 2002. From 1993 to 1998, he was Managing Director of BT Alex. Brown, and from 1988 to 1993, he was Managing Director of UBS Securities, Inc. | ||

J.A. Drummond, age 65 Director | Director since 2003 | |

Mr. Drummond was employed by BellSouth Corporation from 1962 until his retirement in December 2001. He served as Vice Chairman of BellSouth Corporation from January 2000 until his retirement. He was President and Chief Executive Officer of BellSouth Communications Group, a provider of traditional telephone operations and products, from January 1998 until December 1999. He was President and Chief Executive Officer of BellSouth Telecommunications, Inc. from January 1995 until December 1997. Mr. Drummond is also a member of the Board of Directors of Borg-Warner Automotive, AirTran Holdings, Inc. and Centillium Communications, Inc. | ||

J.E. Glancy, age 59 Director | Director since 1994 | |

Dr. Glancy joined the Company in 1976 and served as an Executive Vice President until January 2004 when he commenced part-time employment. Prior thereto, Dr. Glancy served as a Corporate Executive Vice President from 1994 to 2000. | ||

H.M.J. Kraemer, Jr., age 50 Director | Director since 1997 | |

Mr. Kraemer has been an executive partner of Madison Dearborn Partners, LLC, a private equity investment firm, since April 2005, and has served as an adjunct professor at the Kellogg School of Management at Northwestern University since January 2005. Prior thereto, Mr. Kraemer served as the Chairman of Baxter International, Inc. (“Baxter”), a health-care products, systems and services company, from January 2000 until April 2004, as Chief Executive Officer of Baxter from January 1999 until April 2004 and as President of Baxter from April 1997 until April 2004. Mr. Kraemer also served as the Senior Vice President and Chief Financial Officer of Baxter from November 1993 to April 1997. | ||

C.B. Malone, age 68 Director | Director since 1993 | |

Ms. Malone has served as the President of Financial & Management Consulting, Inc., a consulting company, since 1982. Ms. Malone is also a member of the Board of Directors of Hasbro, Inc., Lafarge North America, Lowe’s Companies, Inc. and Novell, Inc. | ||

CLASS II DIRECTORS—TERM ENDING 2007

D.P. Andrews, age Corporate Executive Vice President, | Director since 1996 | |

Mr. Andrews joined the Company in 1993 and has served as a Corporate Executive Vice President since January 1998. In | ||

5

K.C. Dahlberg, age Chief Executive Officer, President, Chairman of the Board and Director | Director since 2003 | |

Mr. Dahlberg has served as Chairman of the Board since July 2004 and Chief Executive Officer and President since November 2003. Prior to joining the Company, Mr. Dahlberg was with General Dynamics Corp. from March 2001 to October 2003, where he served as Executive Vice President. Mr. Dahlberg was with Raytheon International from February 2000 to March 2001, where he served as President, and from 1997 to 2000 he served as President and Chief Operating Officer of Raytheon Systems Company. Mr. Dahlberg held various positions with Hughes Aircraft from 1967 to 1997. | ||

J.P. Walkush, age Executive Vice President and Director | Director since 1996 | |

Mr. Walkush joined the Company in 1976 and has served as an Executive Vice President since 2000. Prior thereto, Mr. Walkush served as a Sector Vice President from 1994 to 2000. | ||

J.H. Warner, Jr., age Corporate Executive Vice President, Chief Administrative Officer and Director | Director since 1988 | |

Dr. Warner joined the Company in 1973 and has served as a Corporate Executive Vice President since 1996 and Chief Administrative Officer since December 2003. Prior thereto, Dr. Warner served as an Executive Vice President from 1989 to 1996. | ||

A.T. Young, age Director | Director since 1995 | |

Mr. Young retired from Lockheed Martin Corp. in 1995 after having served as an Executive Vice President | ||

CLASS III DIRECTORS—TERM ENDING 2005

CLASS I DIRECTORS—TERM ENDING 2006

PROPOSAL II—APPROVAL OF THE 2004 EMPLOYEE STOCK PURCHASE PLAN

General

The Company currently maintains the 2001 Employee Stock Purchase Plan (the "2001 Stock Purchase Plan") which provides for the purchase of Class A Common Stock by participating employees through voluntary payroll deductions. The 2001 Stock Purchase Plan expires by its terms on July 31, 2004. On April 16, 2004, the Board of Directors of the Company approved, subject to stockholder approval, the 2004 Employee Stock Purchase Plan (the "2004 Stock Purchase Plan"), which will enable employees to continue to purchase shares of Class A Common Stock through payroll deductions for a three-year period. The maximum number of shares that may be purchased under the 2004 Stock Purchase Plan, if approved by the stockholders, is limited to the sum of the following (subject to adjustment under certain circumstances): (i) 6,000,000 shares of Class A Common Stock and (ii) the

number of shares of Class A Common Stock that remain available for issuance under the 2001 Stock Purchase Plan as of the effective date of the 2004 Stock Purchase Plan, expected to be approximately 4,500,000 shares, following which date no further shares will be offered under the 2001 Stock Purchase Plan.

The following summary of the terms and provisions of the 2004 Stock Purchase Plan is qualified in its entirety by reference to the full text of the 2004 Stock Purchase Plan, a copy of which is attached to this Proxy Statement as Annex I and incorporated herein by reference. All capitalized or quoted terms have the meanings ascribed to them in the 2004 Stock Purchase Plan unless otherwise defined herein.

Eligibility

Generally, all of the Company's employees will be eligible to participate in the 2004 Stock Purchase Plan, except for employees of subsidiaries which have not been designated as eligible for participation. The Company's Employee Stock Purchase Committee (the "Stock Purchase Committee") may also impose eligibility requirements consistent with Section 423(b) of the Code. No employee, however, who owns capital stock of the Company having more than 5% of the voting power or value of such capital stock will be able to participate. An employee's eligibility to participate in the 2004 Stock Purchase Plan will terminate immediately upon the termination of his or her employment with the Company, upon a change in employment status to a leave of absence or upon transfer to an ineligible subsidiary. As of April 30, 2004, there were approximately 37,200 employees who would have been eligible to participate in the 2004 Stock Purchase Plan.

In addition, the Stock Purchase Committee has the authority to allow employees of any designated subsidiary as well as an entity in which the Company has an equity ownership interest of less than 50% to participate in a non-Code Section 423 component of the 2004 Stock Purchase Plan. The Stock Purchase Committee has the power and authority to modify the eligibility for and terms and conditions of participation in the 2004 Stock Purchase Plan by such employees. Shares purchased by employees of such entities will not be eligible for the favorable tax treatment under Section 423 of the Code.

Employees will be able to enroll in the 2004 Stock Purchase Plan by completing a payroll deduction authorization form and providing it to the designated officials of the Company. The minimum and maximum payroll deduction percentage will be determined by the Committee. Currently, the minimum payroll deduction allowed is 1% of compensation and the maximum allowable deduction is 10% of compensation unless and until a different maximum percentage is established by the Stock Purchase Committee. No employee is entitled to purchase an amount of Class A Common Stock having a fair market value (measured as of its purchase date) in excess of $25,000 in any calendar year pursuant to the 2004 Stock Purchase Plan and any other employee stock purchase plan which may be adopted by the Company.

Purchase of Shares

Shares of Class A Common Stock purchased under the 2004 Stock Purchase Plan may be acquired in the Company's Limited Market or purchased from the Company out of its authorized but unissued shares. At each of four predetermined purchase dates during the year, the agent under the 2004 Stock Purchase Plan (the "Agent") will purchase for the account of each participant in the 2004 Stock Purchase Plan the whole number of shares of Class A Common Stock which may be acquired with the funds available in the participant's account, together with the Company's contribution described below.

The Company will contribute a certain percent of the cost of each share of Class A Common Stock purchased under the 2004 Stock Purchase Plan. The percent to be contributed by the Company (the "Company Percent") will be determined by the Stock Purchase Committee and will be between zero percent (0%) and fifteen percent (15%). The Company Percent will be fifteen percent (15%) unless and until changed by the Stock Purchase Committee. On each purchase date, the Company will

pay the Company Percent of the cost of each share purchased by the Agent whether purchased in the Limited Market or as a newly issued share.

The purchase price to be paid for the shares of Class A Common Stock acquired for the account of participants will be the Formula Price in effect as of the date of purchase. As of April 30, 2004, the Formula Price for the Class A Common Stock was $37.34 per share.

Plan Benefits

The amount of benefits to be provided to employees pursuant to the 2004 Stock Purchase Plan will depend upon such employee's level of participation, the Company's stock price performance and the Company Percent. Therefore, the benefits and amount of awards that will be received by each of the Named Executive Officers, the executive officers as a group and all other employees as a group under the 2004 Stock Purchase Plan are not presently determinable.

Distribution and Voting Rights

Participants shall have the right to vote the shares of Class A Common Stock purchased under the 2004 Stock Purchase Plan. Shares of Class A Common Stock acquired under the 2004 Stock Purchase Plan will be distributed to each participant prior to any record date established by the Company for any vote of its stockholders and in the interim will be held by the Agent for the account of such participant.

Restrictions on Shares Purchased

Pursuant to the Company's Restated Certificate of Incorporation, all shares of Class A Common Stock purchased pursuant to the 2004 Stock Purchase Plan will be subject to the Company's right of repurchase upon the participant's termination of employment or affiliation with the Company at the then prevailing Formula Price. All such shares will also be subject to the Company's right of first refusal in the event that the participant desires to sell such shares other than in the Company's Limited Market.

Withdrawals

Participants may withdraw from the 2004 Stock Purchase Plan, terminate their election to purchase shares and obtain repayment of the balance of any monies held in their accounts at any time prior to the acquisition of shares of Class A Common Stock therewith. No interest will be paid on the money held in the accounts of the participants, unless required by applicable law.

Amendment and Termination

The Board of Directors of the Company may suspend or amend the 2004 Stock Purchase Plan in any respect, except that no amendment may, without the approval of a majority of the voting power of the capital stock of the Company present or represented and entitled to vote at a duly constituted meeting of the stockholders, (i) increase the maximum number of shares authorized to be issued by the Company under the 2004 Stock Purchase Plan or (ii) deny to participating employees the right at any time to withdraw from the 2004 Stock Purchase Plan and thereupon obtain all amounts then due to their credit in their accounts.

The 2004 Stock Purchase Plan will terminate on July 31, 2007, unless earlier terminated by the Board of Directors.

Administration

The 2004 Stock Purchase Plan will be administered by the Stock Purchase Committee, whose members are appointed by the Company's Board of Directors to serve at the discretion of the Board. Members of the Stock Purchase Committee will not receive any compensation from the 2004 Stock Purchase Plan or the Company for services rendered in connection therewith.

Agent

The Company or its designee will be the Agent of the 2004 Stock Purchase Plan.

Federal Income Tax Consequences

For federal income tax purposes, no taxable income will be recognized by a participant in the 2004 Stock Purchase Plan until the taxable year of sale or other disposition of the shares of Class A Common Stock acquired under the part of the plan which qualifies under Code Section 423. When the shares are disposed of by a participant two years or more from the date such shares were purchased for the participant's account by the Agent, the participant must recognize ordinary income for the taxable year of disposition to the extent of the lesser of (i) the excess of the fair market value of the shares on the purchase date over the amount of the purchase price paid by the participant (the "Discount") or (ii) the excess of the fair market value of the shares at disposition or death over the purchase price. In the event of a participant's death while owning shares acquired under the 2004 Stock Purchase Plan, ordinary income must be recognized in the year of death in the amount specified in the foregoing sentence. When the shares are disposed of prior to the expiration of the two-year holding period specified above (a "disqualifying disposition"), the participant must recognize ordinary income in the amount of the Discount, even if the disposition is by gift or is at a loss. Additional gain, if any, will be short-term or long-term capital gain depending on whether the holding period is more than 12 months or 12 months or less.

In the cases discussed above (other than death), the amount of ordinary income recognized by a participant is added to the purchase price paid by the participant and this amount becomes the tax basis for determining the amount of the capital gain or loss from the disposition of the shares, assuming that the shares are a capital asset in the hands of the participant.

Net capital gains from the disposition of capital stock held more than 12 months are currently taxed at a maximum federal income tax rate of 15% and net capital gains from the disposition of stock held not more than 12 months is taxed as ordinary income (maximum rate of 35%). However, limitations on itemized deductions and the phase-out of personal exemptions may result in effective marginal tax rates higher than 15% for net capital gains and 35% for ordinary income.

The Company will not be entitled to a deduction at any time for the shares issued pursuant to the part of the 2004 Stock Purchase Plan which qualifies under Code Section 423 if a participant holding such shares continues to hold his or her shares or disposes of his or her shares after the required two-year holding period or dies while holding such shares. If, however, a participant disposes of such shares prior to the expiration of the two-year holding period, the Company is allowed a deduction to the extent of the amount of ordinary income includable in gross income by such participant for the taxable year as a result of the premature disposition of the shares, subject to the deduction limitation of Code Section 162(m).

A participant purchasing shares under the non-Code Section 423 component of the Plan will be taxed at ordinary income rates on the Discount at the time of purchase, and the Company will be entitled to a deduction of the same amount.

Section 162(m)

Section 162(m) of the Code generally disallows a federal income tax deduction to any publicly held corporation for compensation paid in excess of $1 million in any taxable year to the chief executive officer or any of the other four most highly compensated executive officers who are employed by the corporation on the last day of the taxable year. Compensation equal to the Discount recognized by the participant on the disqualifying disposition of shares purchased under the 2004 Stock Purchase Plan less than one year after the purchase of such shares will not qualify for any exception to Code Section 162(m).

Scope of Discussion

The foregoing discussion is intended only as a summary of certain relevant federal income tax consequences and does not purport to be a complete discussion of all of the tax consequences of participation in the 2004 Stock Purchase Plan. Accordingly, participants should consult their own tax advisors with respect to all federal, foreign, state and local tax effects of participation in the 2004 Stock Purchase Plan. Moreover, the Company does not represent that the foregoing tax consequences will apply to any participant's specific circumstances or will continue to apply in the future and makes no undertaking to maintain the tax-qualified status of the 2004 Stock Purchase Plan.

Recommendation of the Board of Directors; Vote Required

The Board of Directors believes that approval of the 2004 Stock Purchase Plan is in the best interest of the Company and its stockholders because it provides a means for employees to acquire or increase their stock ownership, thereby aligning their financial interest with the Company's.The Board of Directors has approved the 2004 Stock Purchase Plan and recommends that stockholders vote FOR the approval and adoption of the 2004 Stock Purchase Plan.

The affirmative vote of the holders of a majority of the voting power of Class A Common Stock and Class B Common Stock, voting together as a single class, present or represented and entitled to vote at the Annual Meeting is required to approve the 2004 Stock Purchase Plan. A stockholder who signs and submits a ballot or proxy is "present," so an abstention will have the same effect as a vote against those proposals. If the 2004 Stock Purchase Plan is not approved by the Company's stockholders, it will not be implemented.

PROPOSAL III—STOCKHOLDER PROPOSAL REGARDING THE COMPANY'SCOMPANY’S CLASSIFIED BOARD

This proposal was submitted by Christopher A. Smith, 3440 Hamlin Road, Lafayette, California 94549. As of April 30, 2004,the Record Date, Mr. Smith beneficially owned 28,93527,384 shares of the Company'sCompany’s Class A Common Stock.common stock.

Resolved: That SAIC stockholders recommend that the Board of Directors take the necessary steps, in compliance with state law, to declassify the Board for the purpose of director elections and to implement annual director elections. The Board'sBoard’s declassification shall be completed in a manner that does not affect the unexpired terms of directors previously elected.

Stockholder'sStockholder’s Supporting Statement

The Board of Directors is currently separated into three classes. Each year stockholders are requested to vote on directors comprising one of the classes for a three-year term. Because of the classified (or "staggered"“staggered”) board structure, stockholders have the opportunity to vote only on roughly one-third of the directors each year.

Election

In 2004, as reported in SAIC’s 10-Q quarterly report for the period ended July 31, 2004, a shareholder proposal recommending that the Board of corporate directors isDirectors take the necessary steps, in compliance with state law, to declassify the Board for purposes of director elections and to implement annual director elections was rejected by a primary avenuevote of 105,079,635 votes against and 21,953,031 for, stockholders to influence corporate affairs and exert accountability on management. while 7,275,353 shares abstained.

The proponent is of the opinion that the currentthat:

board structure without annual elections reduces the accountability of directors to stockholders. The proponentability of stockholders to vote on all directorseach year will maintain and enhance accountability.

6

The shareholder urges you to research this issue and to mark your proxy FOR this resolution.

Board of Directors'Directors’ Statement in Opposition to the Stockholder Proposal

The Board of Directors unanimously recommends a voteAGAINST this proposal for the reasons set forth below.

The Board of Directors has carefully considered the arguments for and against a classified board.board, particularly in light of the vote on a similar proposal at last year’s Annual Meeting. The Board of Directors has concluded that continuing SAIC'sSAIC’s classified board is in the best interests of our stockholders and opposes the proposal to change it for the following reasons:

ŸPrevious Opposition by SAIC Stockholders.Mr. Smith presented an identical proposal to our stockholders last year which was rejected by our stockholders. Our stockholders determined last year that this proposal was not in their best interests.

ŸContinuity and Stability. The Company'sCompany’s employee ownership philosophy and structure is unique and significantly different from other public companies. The classified board structure allows for a majority of directors to have the benefit of experience with our employee ownership, stock pricing and other policies and values that we believe differentiate the Company from most of its competitors. Further, the Company has recently completed a succession plan in which the Board of Directors selected a new Chief Executive Officer to succeed our founder after 35 years of his leadership. Continuity on the board, particularly during times of transition, is viewed by the Board of Directors as being beneficial to the Company's stockholders.

ŸLong-Term Focus. The Board of Directors is the governing body that has oversight responsibilities for the Company'sCompany’s strategic, long-term planning. The Board of Directors believes that a classified board with staggered, three-year terms for directors promotes a longer-term focus and better facilitates the Company'sCompany’s long-term planning process.

ŸValue Protection. For many companies, a classified board is viewed as one of the primary means to protect the company against the abuses that can result from a hostile takeover attempt. Although a classified board would not prevent an unsolicited takeover from being consummated, it could give the Board additional time to consider alternative proposals and act in the best interests of the Company and its stockholders. The Board of Directors believes that the continuation of our classified board structure would help protect against hostile takeover attempts not deemed to be in the best interests of stockholders.

ŸDirector Accountability and Corporate Governance.. The Board of Directors believes that electing directors to three-year terms does not reduce their accountability or linkage to our stockholders. Directors have the same legal duties and responsibilities to the Company, regardless of the length of their term. Directors who are elected to three-year terms are not insulated from legal responsibility, and are just as accountable to stockholders as those who are elected annually.

annually and are just as likely to consider innovative ways to positively impact stockholder value.

ŸDirector Recruitment and Retention. Three-year terms may be more attractive to highly qualified individuals who are likely to be in demand for other board positions. As a result, the Company'sCompany’s current three-year director term may make it easier for the Company to attract and retain highly qualified candidates who will provide valuable oversight of the Company, benefiting all stockholders.

7

Unanimous Recommendation of the Board of Directors; Vote Required

The Board of Directors unanimously recommends a vote AGAINST the stockholder proposal. The affirmative vote of the holders of a majority of the voting power of Class A Common Stockcommon stock and Class B Common Stock,common stock, voting together as a single class, present or represented and entitled to vote at the Annual Meeting is required to approve the proposal. Shares of Common Stock represented by properly executed, timely received and unrevoked proxies will be voted in accordance with the instructions indicated thereon. A stockholder who signs and submits a ballot or proxy is "present,"“present,” so an abstention will have the same effect as a vote against the proposal. In the absence of specific instructions, properly executed, timely received and unrevoked proxies will be voted AGAINST the stockholder proposal.

Board of Directors Meetings and Committees

During the year ended January 31, 2004 ("2005 (“Fiscal 2004"2005”), the Board of Directors held teneight meetings. Average attendance at such meetings of the Board of Directors was 98%94%. During Fiscal 2004,2005, all incumbent Directors attended at least 75% of the aggregate of the meetings of the Board of Directors and committees of the Board of Directors on which they served.Directors. In addition, all Directors other than M.E. Trout and A.T. YoungJ.E. Glancy attended the 20032004 Annual Meeting of Stockholders. It is the Company'sCompany’s policy that all Directors attend the Company'sCompany’s annual meetings.

The Board of Directors has variousthe following standing committees, includingcommittees: an Audit Committee, a Compensation Committee, an Ethics and Corporate Responsibility Committee, an Executive Committee, and a Nominating and Corporate Governance Committee and a Stock Policy Committee. The charters of all committees of the Board of Directors are available at the Company’s website atwww.saic.com/corporategovernance/.

Audit Committee

The functions of the Audit Committee are described below under the heading "Audit“Audit Committee Report." TheReport” and the Audit Committee'sCommittee’s charter is attached to this Proxy Statement as Annex II.I. The Audit Committee held ten meetings during Fiscal 2004.2005. The Audit Committee is comprised of five independent directors as defined by the current listing standards of the National Association of Securities Dealers.Dealers and the Company’s Corporate Governance Guidelines. The Board of Directors has determined that J.A. Drummond, H.M.J. Kraemer, Jr. and C.B. Malone qualify as Audit Committee financial experts as defined by the rules under the Securities Exchange Act of 1934, as amended. The current members of the Audit Committee are C.B. Malone (Chairperson), W.H. Demisch, J.A. Drummond, A.K. Jones and H.M.J. Kraemer, Jr.

Compensation Committee

The Compensation Committee'sCommittee’s responsibilities include: (i) approvingdetermining the salariescompensation of the Chief Executive Officer and allreviewing and approving the compensation of the other executive officers named pursuant to Section 16 of the Securities Exchange Act of 1934 ("Executive Officers");1934; (ii) approving anyand evaluating compensation contractsplans, policies and programs, including incentive compensation and equity-based plans for employees and officers; (iii) preparing an annual report on executive compensation for inclusion in the Company’s proxy statement or severance packages for Executive Officers; (iii) establishing objective performance goals forAnnual Report on Form 10-K, in accordance with the Executive Officers under the Company's Bonus Compensation Planrules and the amounts potentially payable if such goals are satisfied; (iv) administering such objective performance goals and determining the amounts to be paid; (v) issuing reports required byregulations of the Securities and Exchange Commission regarding the Company's compensation policies applicableand (iv) reviewing and making recommendations to the Chief Executive Officer and the four other most highly compensated executive officers and (vi) approving and recommending to the full Board of Directors the compensation paid to outside Directors for their services as members of the Company's Board of Directors.regarding director compensation. The Compensation Committee held eight meetings during Fiscal 2004.2005. The Compensation Committee consists of Directors who are "outside directors" within“independent” as defined by the meaning of Section 162(m)current listing standards of the Internal Revenue CodeNational Association of 1986, as amendedSecurities Dealers and "non-employee directors" within the meaning of Rule 16b-3 of the Securities Exchange Act of 1934, as amended.Company’s Corporate Governance Guidelines. The current members of the Compensation Committee are A.T. YoungE.J. Sanderson, Jr. (Chairperson), W.H. Demisch and A.K. Jones.

Ethics and Corporate Responsibility Committee

The Ethics and Corporate Responsibility Committee duties include: (i) reviewing and making recommendations regarding the ethical responsibilities of the Company’s employees and consultants under the

8

Company’s administrative policies and procedures; (ii) reviewing and assessing the Company’s policies and procedures addressing the resolution of conflicts of interest involving the Company, its employees, officers and directors and addressing any potential conflict of interest involving the Company and a director or an executive officer; (iii) reviewing and establishing procedures for the receipt, retention and treatment of complaints regarding violation of the Company’s policies, procedures and standards related to ethical conduct and legal compliance and (iv) reviewing and evaluating the effectiveness of the Company’s ethics, compliance and training programs and related administrative policies. The Ethics and Corporate Responsibility Committee held four meetings during Fiscal 2005. The current members of the Ethics and Corporate Responsibility Committee are A.K. Jones (Chair), W.A. Downing, J.A. Drummond, A.K. Jones, H.M.J. Kraemer, Jr., C.B. Malone E.J. Sanderson,and J.H. Warner, Jr., R. Snyderman and M.E. Trout.

Executive Committee

The Executive Committee'sCommittee’s charter provides that, to the extent permitted by Delaware law, it shall have and may exercise all powers and authorities of the Board of Directors with respect to the following: (i) taking action on behalf of the Board of Directors during intervals between regularly scheduled meetings of the Board of Directors if it is impractical to delay action on a matter until the next regularly scheduled meeting of the Board of Directors andDirectors; (ii) overseeing and assisting management in the formulation and implementation of human resource management, scientific research policies; (iii) authorizing and approving the offer, issuance or sale of the Company’s capital stock; (iv) authorizing the filing of registration statements, reports and other documents with the Securities and Exchange Commission and with state securities commissions; (v) authorizing the calling of the Annual Meeting of Stockholders of the Company; (vi) within certain limits established by the Board or Directors, approving the acquisition of the business or assets of another company; (vii) authorizing the preparation and filing of documentation to effect a merger between the Company and one or more subsidiary corporations; (viii) reviewing and approving various financial matters, including matters pertaining to the capital structure of the Company, the Company’s financial projections, plans and strategies, the Company’s capital budget and capital budgeting processes, plans and strategies and the Company’s treasury operations, investment strategies, banking and cash management arrangements and financial risk management, including the Company’s policies and financial matters.procedures related thereto and (ix) authorizing the opening of bank accounts in the name of the Company, approving the establishment of loans or letters of credit and guaranteeing the repayment of indebtedness or contractual performance of majority-owned subsidiaries of the Company. The Executive Committee held five meetings during Fiscal 2004.2005. The current

members of the Executive Committee are K.C. DahlbergA.T. Young (Chairperson), D.P. Andrews, J.R. Beyster, M.J. Desch,K.C. Dahlberg, W.H. Demisch, J.E. Glancy, S.D. Rockwood, M.E. Trout, J.H. Warner,H.M.J. Kraemer, Jr. and A.T. Young.E.J. Sanderson, Jr.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee'sCommittee’s responsibilities include: (i) establishing a procedure for identifying nominees for election asand recommending individuals qualified to become members of the Board of Directors, toconsistent with the criteria approved by the Board; (ii) reviewing and making recommendations regarding the composition and procedures of the Board of Directors; (ii) reviewing(iii) developing and recommending to the Board a set of Directors criteria for membership oncorporate governance principles; (iv) making recommendations regarding the size, composition and charters of the committees of the Board; (iii) proposing nominees to fill vacancies on the Board of Directors as they occur; (iv) evaluating(v) reviewing and recommending candidatesdeveloping long-range plans for the position of Chief Executive Officer in the event a vacancy arises or is anticipated to arise; (v) consulting with the Chief Executive Officer with respect to the evaluation and performancemanagement succession and (vi) developing and overseeing an annual self-evaluation process of the Company's executive officersBoard and members of management considered capable of becoming executive officers of the Company; and (vi) addressing matters of corporate governance not otherwise delegated to other committees of the Board. The Nominating Committee and the Governance Committee were combined to form the Nominating and Corporate Governance Committee at the October 10, 2003 Board of Directors meeting.its committees. A copy of the Nominating and Corporate Governance Committee'sCommittee’s charter is available at the Company'sCompany’s website at www.saic.com/corporategovernance/.

The Nominating and Corporate Governance Committee (including meetings of the Nominating Committee and the Governance Committee before the combination) held twosix meetings during Fiscal 2004.2005. The current members of the Nominating and Corporate Governance Committee are A.T. YoungJ.A. Drummond (Chairperson), J.R. Beyster, W.H. Demisch, W.A. Downing,D.P. Andrews, K.C. Dahlberg, C.B. Malone, J.H. Warner, Jr. and A.T. Young. J.A. Drummond, A.K. Jones, H.M.J. Kraemer, Jr., C.B. Malone S.D. Rockwood, E.J. Sanderson, Jr., R. Snyderman and M.E. Trout. W.H. Demisch, J.A. Drummond, A.K. Jones, H.M.J. Kraemer, Jr., C.B. Malone, E.J. Sanderson, Jr., R. Snyderman, M.E. Trout and A.T. Young are independent directors as defined by the current listing standards of the National Association of Securities Dealers.Dealers and the Company’s Corporate Governance Guidelines.

9

The Nominating and Corporate Governance Committee considers recommendations for director nominees from a wide variety of sources, including members of our Board, business contacts, community leaders and members of our management. To date, the Company has not utilized the services of any third parties to which it paid a fee to assist in identifying or evaluating candidates. The Nominating and Corporate Governance Committee also would consider any stockholder recommendation for director nominees that is properly received in accordance with our Bylaws, as discussed below, and applicable rules and regulationregulations of the SEC.Securities and Exchange Commission.

The Board believes that all of its directors should have the highest personal integrity and have a record of exceptional ability and judgment. Nominees for Director should possess the level of education, experience, sophistication and expertise required to perform the duties of a member of the Board of Directors of a public company ofhas delegated to the Company's size and scope. The Nominating and Corporate Governance Committee evaluates all candidatesthe responsibility for recommending nominees for membership on the basisBoard. In discharging this responsibility, the Nominating and Corporate Governance Committee receives input from the Chairman of the above qualifications, the existing composition and mix of talent and expertise on the Board and Chief Executive Officer. The Board believes its membership should reflect a broad range of experience, knowledge and judgment beneficial to the broad business diversity of the Company. The Company expects a high level of commitment from the Directors and will review a candidate’s other criteriacommitments and service on other boards to ensure that may vary fromthe candidate has sufficient time to time.devote to the Company. In evaluating a candidate,recommending nominees for membership on the Board, the Nominating and Corporate Governance Committee will consider all available information concerningobserve the candidate,following principles: (i) a majority of Directors must meet the independence criteria established by the Company, (ii) based upon the desired Board size of 12 Directors, no more than five Directors may solicit the views of management and other membersbe employees of the BoardCompany, (iii) only full-time employees who serve as either the Chief Executive Officer or a direct report to the Chief Executive Officer will be considered as candidates for an employee director position and (iv) no director nominee may conduct interviews of proposed candidates.be a consultant to the Company.

Any stockholder may nominate a person for election as a Director of the Company by complying with the procedure set forth in the Company'sCompany’s Bylaws. Pursuant to Section 3.03 of the Company'sCompany’s Bylaws, in order for a stockholder to nominate a person for election as a Director, such stockholder must give timely notice to the Secretary of the Company prior to the meeting at which Directors are to be elected. To be timely, notice must be received by the Secretary not less than 50 days nor more than 75 days prior to the meeting (or if fewer than 65 days'days’ notice or prior public disclosure of the meeting date is given or made to stockholders, not later than the 15th day following the day on which the notice of the date of the meeting was mailed or such public disclosure was made). Such notice must contain certain information about the nominee, including his or her name, age, business and residence

addresses and principal occupation during the past five years, the class and number of shares of Common Stock beneficially owned by such nominee and such other information as would be required to be included in a proxy statement soliciting proxies for the election of the proposed nominee. The notice must also contain certain information about the stockholder proposing to nominate that person. Pursuant to Section 3.03 of the Company'sCompany’s Bylaws, the Company may also require any proposed nominee to furnish other information reasonably required by the Company to determine the proposed nominee'snominee’s eligibility to serve as a Director.

Stock Policy Committee

The Stock Policy Committee responsibilities include: (i) during intervals between the regularly scheduled meetings of the Board of Directors, exercising all the powers and authority of the Board of Directors with respect to establishing the Market Factor in the Company’s stock price formula and the fair market value price of the Class A common stock; (ii) selecting an independent appraisal firm to review the value of the Company’s stock; (iii) reviewing and recommending any changes to the formula adopted by the Board of Directors for the purpose of determining the fair market value of the Company’s Class A and Class B common stock and (iv) reviewing and recommending any changes to the Company’s stock programs and in the function of the Company’s broker dealer subsidiary, Bull, Inc. The Stock Policy Committee held eight meetings during Fiscal 2005. The current members of the Stock Policy Committee are J.P. Walkush (Chair), K.C. Dahlberg, W.H. Demisch, D. H. Foley and A.T. Young.

10

Retirement Policies

The recommended retirement age for an outside director, other thanindependent directors is age 72 and the former chief executive officer and founder of this Company, is 72 years of age. The recommended retirement age for an inside director, other thanemployee directors is age 65. It is the former chief executive officer and founder of this Company, is 65 years of age.

The mandatory retirement date for officers designated under Section 16policy of the Securities Exchange ActNominating and Corporate Governance Committee to nominate only candidates who will not attain the applicable retirement age during their term of 1934, as amended ("Section 16 Officers"), isoffice or those who have agreed to resign from the date of the first annual meeting of stockholders that occurs after the Section 16 Officer's 65thBoard upon their applicable birthday. However, any Section 16 Officer that was age 65 or older at the time the retirement policy was adopted in October 2003 will be allowed to serve as a Section 16 Officer for up to an additional three-year transition period.

Communications with the Board

Stockholders may communicate with an individual Director,contact Directors by writing to them either individually, the independent Directorsdirectors as a group, or the Company's entire Board of Directors by contacting Douglas E. Scott, Senior Vice President, General Counsel andat the following address:

SAIC

Corporate Secretary at:

Science Applications International Corporation

10260 Campus Point Drive,

M/S F-3

San Diego, CA 92121(858) 826-6000

All communications to an individual Director will be forwarded directly to the individual Director or, if sent to the Board of Directors, it will be forwarded to the Chairman of the Board of Directors and the Chairman of the Nominating and Corporate Governance Committee.Lead Director. Communications sent to the independent Directors as a group will be forwarded to the Lead Director on behalf of all independent Directors.

11

EXECUTIVE AND DIRECTORS COMPENSATION

Summary Compensation

The following table (the "Summary“Summary Compensation Table"Table”) sets forth information regarding the annual and long-term compensation for services in all capacities to the Company for the fiscal years ended January 31, 2005, 2004 2003 and 2002,2003, of those persons who were, at January 31, 20042005 (i) the Chief Executive Officer (ii) the former Chief Executive Officer and (iii)(ii) the other four most highly compensated executive officers of the Company (collectively, the "Named“Named Executive Officers"Officers”). The Summary Compensation Table sets forth the annual and long-term compensation earned by the Named Executive Officers for the relevant fiscal year, whether or not paid in such fiscal year.

Summary Compensation Table

| | | | | Long-Term Compensation | | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Annual Compensation | | Number of Securities Underlying Options | | |||||||||||

| Name and Principal Position | Fiscal Year | Restricted Stock Awards(3) | All Other Compensation(4) | |||||||||||||

| Salary(1) | Bonus(2) | |||||||||||||||

| K.C. Dahlberg Chief Executive Officer and President | 2004 | $ | 250,000 | (5) | $ | 1,010,000 | (6) | 0 | 225,000 | (7) | $ | 0 | ||||

J.R. Beyster(8) | 2004 2003 2002 | $ $ $ | 1,047,116 988,898 969,231 | $ $ $ | 1,000,000 1,000,000 1,000,000 | $ $ $ | 0 0 0 | 0 0 0 | $ $ $ | 13,445 13,308 12,981 | ||||||

D.P. Andrews | 2004 2003 2002 | $ $ $ | 504,519 467,308 442,207 | $ $ $ | 699,992 600,014 500,003 | $ $ $ | 199,984 200,000 200,007 | 100,000 75,000 100,000 | $ $ $ | 13,445 13,308 12,981 | ||||||

T.E. Darcy | 2004 2003 2002 | $ $ $ | 470,000 425,001 415,385 | $ $ $ | 599,992 500,014 490,003 | $ $ $ | 99,992 100,014 100,003 | 75,000 75,000 100,000 | $ $ $ | 10,945 10,958 0 | ||||||

M.J. Desch | 2004 2003 | $ $ | 515,000 285,675 | (9) | $ $ | 599,984 500,000 | $ $ | 99,992 100,014 | 106,070 204,070 | $ $ | 9,056 9,408 | |||||

J.H. Warner, Jr. | 2004 2003 2002 | $ $ $ | 475,962 428,365 427,289 | $ $ $ | 510,015 449,994 345,010 | $ $ $ | 99,992 125,011 149,988 | 50,000 45,000 60,000 | $ $ $ | 13,445 13,308 12,981 | ||||||

| Annual Compensation | Long-Term Compensation | |||||||||||||

Name and Principal Position | Fiscal Year | Salary(1) | Bonus(2) | Other Annual Compensation(3) | Restricted Stock | Number of Securities Underlying Options | All Other Compensation(5) | |||||||

K.C. Dahlberg Chief Executive Officer and President | 2005 2004 | $1,000,000 $250,000(7) | $1,500,000 $1,010,000(8) | $77,897(6) $229,459(9) | $299,989 0 | 260,000 225,000(10) | $0 $0 | |||||||

D.P. Andrews | 2005 2004 2003 | $628,846 $504,519 $467,308 | $799,996 $699,992 $600,014 | $2,473 $1,305 $3,127 | $199,993 $199,984 $200,000 | 125,000 100,000 75,000 | $9,052 $13,445 $13,308 | |||||||

W.A. Roper, Jr. | 2005 2004 2003 | $475,962 $475,962 $473,847 | $799,996 $500,009 $399,993 | $6,275 $5,825 $7,845 | $130,003 $149,988 $150,007 | 55,000 60,000 75,000 | $9,052 $13,442 $13,308 | |||||||

T.E. Darcy | 2005 2004 2003 | $480,000 $470,000 $425,001 | $599,996 $599,992 $500,014 | $400 $400 $500 | $130,003 $99,992 $100,014 | 80,000 75,000 75,000 | $6,402 $10,945 $10,958 | |||||||

J.H. Warner, Jr. | 2005 2004 2003 | $475,962 $475,962 $428,365 | $550,018 $510,015 $449,994 | $5,375 $4,725 $4,800 | $99,996 $99,992 $125,011 | 55,000 50,000 45,000 | $9,052 $13,445 $13,308 | |||||||

stock. Restricted stock vests as to 20%, 20%, 20%, and 40% on the first, second, third, and fourth year anniversaries of the date of grant, respectively. See "Continued Vesting on Vesting Stock and Options for Retirees" for rights to continued vesting after retirement for certain holders. The amount reported represents the following number of restricted shares of Class A common stock awarded for Fiscal Years 2004, 2003 and 2002, respectively: D.P. Andrews: 5,476 shares, 6,993 shares and 6,070 shares; T.E. Darcy: 2,738 shares, 3,497 shares and 3,035 shares; M.J. Desch: 2,738 shares, 3,497 shares and 0 shares; and J.H. Warner, Jr.: 2,738 shares, 4,371 shares and 4,552 shares. As of January 31, 2004, the aggregate restricted stock holdings (other than restricted stock which has been deferred into the Key Executive Stock Deferral Plan) for the Named Executive Officers were as follows: K.C. Dahlberg: 0 shares; J.R. Beyster: 0 shares; D.P. Andrews: 4,856 shares, with a market value as of such date of $177,341; T.E. Darcy: 5,319 shares, with a market value as of such date of $194,250; M.J. Desch: 0 shares; and J.H. Warner, Jr.: 6,627 shares, with a market value as of such date of $242,018. Dividends are payable on such restricted stock if and when declared. However, the Company has never declared or paid a dividend on its capital stock and no dividends on its capital stock are contemplated in the foreseeable future.

| (1) | Includes amounts paid in lieu of unused comprehensive leave. |

| (2) | Includes the award of the following number of shares of Class A common stock with a market value as of the date of grant (calculated by multiplying the Formula Price of the Class A common stock on the date of grant by the number of shares awarded) for Fiscal Years 2005, 2004 and 2003, respectively, as follows: K.C. Dahlberg: 10,000 shares with a market value of $405,500, 0 shares and 0 shares; D.P. Andrews: 2,466 shares with a market value of $99,996, 2,738 shares with a market value of $99,992 and 3,497 shares with a market value of $100,014; W.A. Roper, Jr.: 2,466 shares with a market value of $99,996, 1,917 shares with a market value of $70,009 and 1,748 shares with a market value of $49,993; T.E. Darcy: 2,466 shares with a market value of $99,996, 2,738 shares with a market value of $99,992 and 3,497 shares with a market value of $100,014 and J.H. Warner, Jr.: 1,850 shares with a market value of $75,018, 2,191 shares with a market value of $80,015 and 2,797 shares with a market value of $79,994. |

| (3) | Represents amounts paid or reimbursed by the Company on behalf of the Named Executive Officers for athletic, airline and country club memberships, financial planning and tax preparation services and relocation expenses. |

12

| (4) | The amount reported represents the market value on the date of grant (calculated by multiplying the Formula Price of the Class A common stock on the date of grant by the number of shares awarded), without giving effect to the diminution in value attributable to the restrictions on such stock. Restricted stock vests as to 20%, 20%, 20% and 40% on the first, second, third and fourth year anniversaries of the date of grant, respectively. See “Continued Vesting on Vesting Stock and Options for Retirees” for rights to continued vesting after retirement for certain holders. The amount reported represents the following number of restricted shares of Class A common stock awarded for Fiscal Years 2005, 2004 and 2003, respectively: K.C. Dahlberg: 7,398 shares, 0 shares and 0 shares; D.P. Andrews: 4,932 shares, 5,476 shares and 6,993 shares; W.A. Roper, Jr.: 3,206 shares, 4,107 shares and 5,245 shares; T.E. Darcy: 3,206 shares, 2,738 shares and 3,497 shares and J.H. Warner, Jr.: 2,466 shares, 2,738 shares and 4,371 shares. As of January 31, 2005, the aggregate restricted stock holdings (other than restricted stock which has been deferred into the Key Executive Stock Deferral Plan) for the Named Executive Officers were as follows: K.C. Dahlberg: 0 shares; D.P. Andrews: 9,118 shares, with a market value as of such date of $369,735; W.A. Roper, Jr.: 0 shares; T.E. Darcy: 4,048 shares, with a market value as of such date of $164,146 and J.H. Warner, Jr.: 3,411 shares, with a market value as of such date of $138,316. Dividends are payable on such restricted stock if and when declared. However, the Company has never declared or paid a dividend on its capital stock. |

| (5) | Represents amounts contributed or accrued by the Company for the Named Executive Officers under the Company’s 401(k) Profit Sharing Plan and ESRP. |

| (6) | Includes $67,897 for country club dues. See “Employment Agreements.” |

| (7) | Mr. Dahlberg joined the Company as Chief Executive Officer in November 2003. Mr. Dahlberg’s annual salary for Fiscal 2004 would have been $1,000,000. |

| (8) | Includes $660,000 paid as a cash sign on bonus. See “Employment Agreements.” |

| (9) | Represents the reimbursement of expenses incurred in connection with the relocation of K.C. Dalhberg and his family to the Company’s principal place of business. See “Employment Agreements.” |

| (10) | Issued pursuant to K.C. Dahlberg’s Letter Agreements. See “Employment Agreements.” |

Option Grants

The following table sets forth information regarding grants of options to purchase shares of Class A common stock pursuant to the Company'sCompany’s 1999 Stock Incentive Plan made during Fiscal 20042005 to the Named Executive Officers.

Option Grants In Last Fiscal Year

| | | | | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Number of Securities Underlying Options Granted(1) | % of Total Options Granted to Employees in Fiscal 2004 | | | |||||||||||

| Name | Exercise Price (Per Share) | Expiration Date | |||||||||||||

| 5% | 10% | ||||||||||||||

| K.C. Dahlberg | 225,000 | (3) | 2.2 | % | $ | 31.79 | 11/2/08 | $ | 1,976,173 | $ | 4,366,825 | ||||

| J.R. Beyster | 0 | N/A | N/A | N/A | N/A | N/A | |||||||||

| D.P. Andrews | 75,000 | (4) | * | $ | 28.60 | 4/9/08 | $ | 592,624 | $ | 1,309,544 | |||||

| T.E. Darcy | 75,000 | (4) | * | $ | 28.60 | 4/9/08 | $ | 592,624 | $ | 1,309,544 | |||||

| M.J. Desch | 2,000 100,000 4,070 | (4) | * 1.0 * | % | $ $ $ | 28.60 28.60 29.02 | 2/25/08 4/9/08 5/8/08 | $ $ $ | 15,803 790,165 32,632 | $ $ $ | 34,921 1,746,059 72,108 | ||||

| J.H. Warner, Jr. | 45,000 | (4) | * | $ | 28.60 | 4/9/08 | $ | 355,574 | $ | 785,726 | |||||

Name | Number of Securities Underlying Options Granted(1) | % of Total Options Granted to Employees in Fiscal 2005 | Exercise Price (Per Share)(2) | Expiration Date | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(3) | ||||||||

5% | 10% | ||||||||||||

K.C. Dahlberg | 30,000 30,000 | * * | | $36.52 $37.34 | 3/7/09 5/18/09 | $302,694 $309,491 | $668,875 $683,893 | ||||||

D.P. Andrews | 100,000(4) | 1.4 | % | $36.52 | 4/1/09 | $1,008,980 | $2,229,583 | ||||||

W.A. Roper, Jr. | 60,000(4) | * | $36.52 | 4/1/09 | $605,388 | $1,337,750 | |||||||

T.E. Darcy | 75,000(4) | 1.0 | % | $36.52 | 4/1/09 | $756,735 | $1,672,187 | ||||||

J.H. Warner, Jr. | 50,000(4) | * | $36.52 | 4/1/09 | $504,490 | $1,114,791 | |||||||

respectively. See "Continued Vesting on Vesting Stock and Options for Retirees" for rights to continued vesting after retirement for certain holders.

| * | Less than 1% of the total options granted to employees in Fiscal 2005. |

13

| (1) | All such options vest as to 20%, 20%, 20% and 40% on the first, second, third and fourth year anniversaries of the date of grant, respectively. See “Continued Vesting on Vesting Stock and Options for Retirees” for rights to continued vesting after retirement for certain holders. |

| (2) | The exercise price is equal to the stock price of the Class A common stock on the date of grant. |

| (3) | The potential realizable value is based on an assumption that the Formula Price of the Class A common stock will appreciate at the annual rate shown (compounded annually) from the date of grant until the end of the 5-year option term. These values are calculated based on the regulations promulgated by the Securities and Exchange Commission and should not be viewed in any way as an estimate or forecast of the future performance of the Class A common stock. There can be no assurance that (i) the values realized upon the exercise of the stock options will be at or near the potential realizable values listed in this table, (ii) the Class A common stock will in the future provide returns comparable to historical returns or (iii) the Formula Price will not decline. |

| (4) | Although the listed grants of options were made during Fiscal 2005, such grants relate to the individual’s service for the fiscal year ended January 31, 2004. |

Option Exercises and Fiscal Year-End Values

The following table sets forth information regarding the exercise of options during Fiscal 20042005 and unexercised options to purchase Class A common stock granted during Fiscal 20042005 and prior years under the Company'sCompany’s 1998 Stock Option Plan and 1999 Stock Incentive Plan to the Named Executive Officers and held by them at January 31, 2004.2005.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Value

| | | | Number of Securities Underlying Unexercised Options at January 31, 2004 | Value of Unexercised In-the-Money Options at January 31, 2004(1) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Shares Acquired on Exercise | Value Realized | |||||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

| K.C. Dahlberg | 0 | N/A | 0 | 225,000 | N/A | $ | 1,064,250 | ||||||||

| J.R. Beyster | 0 | N/A | 0 | 0 | N/A | N/A | |||||||||

| D.P. Andrews | 0 | N/A | 180,000 | 255,000 | $ | 2,078,900 | $ | 1,645,000 | |||||||

| T.E. Darcy | 0 | N/A | 118,389 | 225,970 | $ | 698,624 | $ | 1,328,259 | |||||||

| M.J. Desch | 0 | N/A | 20,814 | 189,326 | $ | 158,839 | $ | 1,473,720 | |||||||

| J.H. Warner, Jr. | 80,000 | $ | 1,525,200 | 70,000 | 150,000 | $ | 549,620 | $ | 969,930 | ||||||

Name | Shares Acquired on Exercise | Value Realized | Number of Securities Underlying Unexercised Options at January 31, 2005 | Value of Unexercised In-the-Money Options at January 31, 2005(1) | ||||||||

Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||

K.C. Dahlberg | 0 | N/A | 45,000 | 240,000 | $394,200 | $1,794,000 | ||||||

D.P. Andrews | 60,000 | $1,143,900 | 215,000 | 260,000 | $2,529,450 | $1,964,800 | ||||||

W.A. Roper, Jr. | 45,000 | $857,925 | 243,000 | 222,000 | $2,908,290 | $1,835,760 | ||||||

T.E. Darcy | 0 | N/A | 217,921 | 201,438 | $2,179,157 | $1,537,743 | ||||||

J.H. Warner, Jr. | 60,000 | $733,200 | 66,000 | 144,000 | $610,710 | $1,119,140 | ||||||

| (1) | Based on the Formula Price of the Class A common stock as of such date less the exercise price of such options. |

Employment Agreements

The Company and K. C. Dahlberg are parties to two letter agreements both of which are dated October 3, 2003 ("(“Dahlberg Letter Agreements"Agreements”) pursuant to which Mr. Dahlberg serves as Chief Executive Officer of the Company. The Dahlberg Letter Agreements provide that Mr. Dahlberg will receive (i) a base salary of $1,000,000 per year, (ii) a short-term performance bonus for Fiscal Year 2004 of $1,000,000 with the potential for up to $1,500,000 for extraordinary performance, which bonus will be payable in cash and fully vested SAIC Class A Common Stock, (iii) a cash sign-on bonus of $660,000, (iv) an award of 104,919 shares of SAIC'sSAIC’s vesting Class A Common Stock, (v) an award of a vesting option to purchase up to 225,000 shares of SAIC Class A Common Stock, (vi) reimbursement of expenses incurred in connection with the relocation of Mr. Dahlberg

14

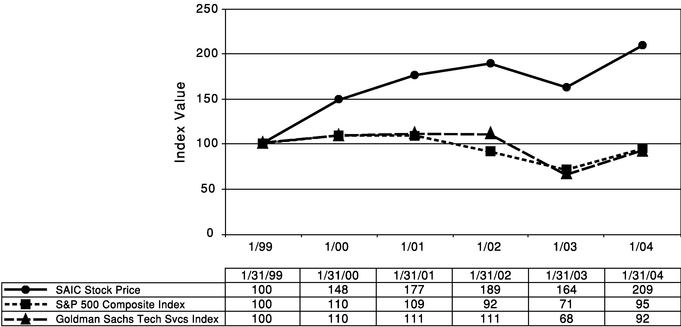

and his family to the Company'sCompany’s principal place of business, and (vi)(vii) a gross up to Mr. Dahlberg'sDahlberg’s salary to cover the federal, state and local income and employment tax liability on the relocation benefits provided by the Company.Company, (viii) a country club membership, (ix) first class seating for business travel, (x) up to $10,000 for financial planning and/or tax preparation within the first two years of employment and (xi) disability insurance. The number of vesting shares actually issued to Mr. Dahlberg was reduced by mutual